by Sean Kosofsky

If you want to raise more money and have more impact, you need a broad universe of people to solicit. You will be less effective with “cold” leads than warm ones, so how can you grow a warm list of leads for your nonprofit? Your email list is a key indicator of your capacity to find volunteers, donors, and effect change.

It’s hard to build a list from nothing, but it can be done. Reaching scale and regular growth becomes easier after you get your first few thousand emails. But even if you have 10,000 emails now, you could do so much more with 20,000. I am sure you’ll agree. More people will want to collaborate with you. Elected leaders will want to know you. The list of benefits of growing an email list is endless.

Nonprofits tend to grow their lists by asking people to sign petitions or pledges or to join their email newsletter. I have spent my life in nonprofits trying to figure this out. But since the Spring, I have had a baptism by fire, growing my own business through a blend of marketing, business development, lead generation, and traditional nonprofit tactics.

I have created a robust list of ways for organizations to grow their email list. Marketers have learned some things about building lists through lead generation, marketing funnels, sales, and conversions. These are all terms that may seem foreign to most nonprofit staff. Nonprofits tend to think people will give us their email because they care about the issue. Marketers have known for some time that giving your email to anyone comes at a cost. So, what if nonprofits give away things of value in exchange for an email? Your newsletter may be awesome but asking someone to subscribe is not the same as giving them something they value.

When you look at the list I have created, you will see it relies very heavily on landing pages and lead magnets. A landing page is a page you create on the internet that is not necessarily attached to your website, but it serves one purpose: a call to action. So, a landing page gets you to download, sign up, buy, enroll, schedule, or take some other action so the content and design of the landing page is singularly focused. Nonprofits need to seriously start utilizing this strategy more. It also helped that it isn’t necessarily expensive. You can subscribe to a landing page service or build your own on your site, but these pages look very different from normal website pages.

Ready for some teasers from the list? 1) Did you know you can export your contact list, with emails, from Linkedin? Well, you can. Ask every board member and staff member if they are comfortable doing this and throw them all into one .csv file. Do the same with your contact list from Gmail, Yahoo, Outlook or other contact list. Then use a program like Mailshake.com to reach out to your “cold emails” to get them to opt-in to your normal email program. 2) Chances are your board, volunteers and staff are participating in many online groups, communities, forums, Facebook groups, etc. After you have built a landing page, casually drop the link into these communities in a way that doesn’t seem like a sales pitch. Again, your landing page should offer a free giveaway that is of high value and solves a “pain point” for people. 3) Consider using your email signature as a place to include your landing page link. Bonus, have all staff and board members use autoresponders, some or all of the time, with a link and pitch for people to grab your lead magnet from your landing page.

Read the list and get back to me. Do you have additional ways to grow a list that you would like to share? Have any of these methods worked or have proven unsuccessful for you?

Check out the tool here. If you have any questions about any of the tips, reach out to me at Sean@MindTheGapConsulting.org

______________________________________

About Sean, our guest writer… Sean Kosofsky is the “Nonprofit Fixer.” He is known nationally for building nonprofit capacity and fighting for marginalized populations for 25 years. He transforms organizations, inspires people to action, and magnifies the impact. Read more about Sean and his work here.

There are hundreds of thousands active nonprofits in the United States. Nonprofits fail every day. Some in small ways, some failures are colossal. Some studies report as many at 80% of nonprofits fail in their first three years.

There are hundreds of thousands active nonprofits in the United States. Nonprofits fail every day. Some in small ways, some failures are colossal. Some studies report as many at 80% of nonprofits fail in their first three years. Here are 7 quick tips to get you started checking your current practices today.

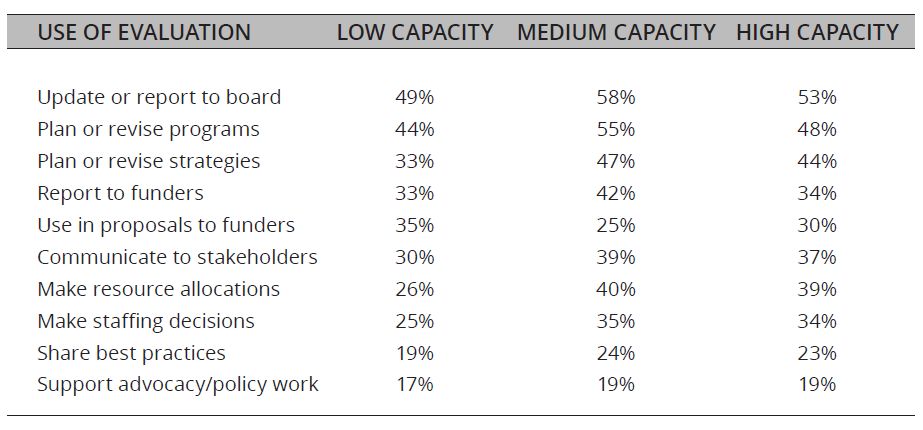

Here are 7 quick tips to get you started checking your current practices today. We often hear discussions about an organization’s “capacity” but for some what that means is unclear. How to assess an organization’s capacity and what to do with the results can be even more puzzling.

We often hear discussions about an organization’s “capacity” but for some what that means is unclear. How to assess an organization’s capacity and what to do with the results can be even more puzzling.